A PAN card for the proprietor. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing.

Types Of Taxes In Malaysia For Companies

A sole proprietorship is a structure most local businessmen tend to venture into.

. The businesss name and address. No corporate tax imposed- As the sole proprietorship is not a separate legal entity from the owner it will not get taxed as such. In order to become a taxpayer you must first register with the IRS if eligible Create a File Registration Form To obtain a copy of the Income Tax Return Form from the LHNDM Branch that is closest to you if the form does not reach on time Filling out Forms B Sole Proprietorship and P Partnership is required.

Please select one of these options. The lower amount of paperwork. A bank account opened in the businesss name.

Full ownership- A sole proprietorship is owned 100 by a single person. If the companys annual revenue reaches Rs. A photocopy of your Identity Card IC.

To start the registration process in Malaysia for either a sole proprietorship or partnership you will need to prepare and provide the following documentation. At the various options available on the ezHASIL page choose myTax. They need to apply for registration of a tax file.

The next RM10000 of your chargeable income 21 of RM10000 RM2100. Prepare the required registration fee of RM60-RM100 cash. As a sole proprietor on the other hand youre responsible for 100 of these taxes.

This being said most sole proprietors only need to file two forms with their individual return. Basically this means you are the business and the business is you. Only available for Malaysian Citizens and PR holders only.

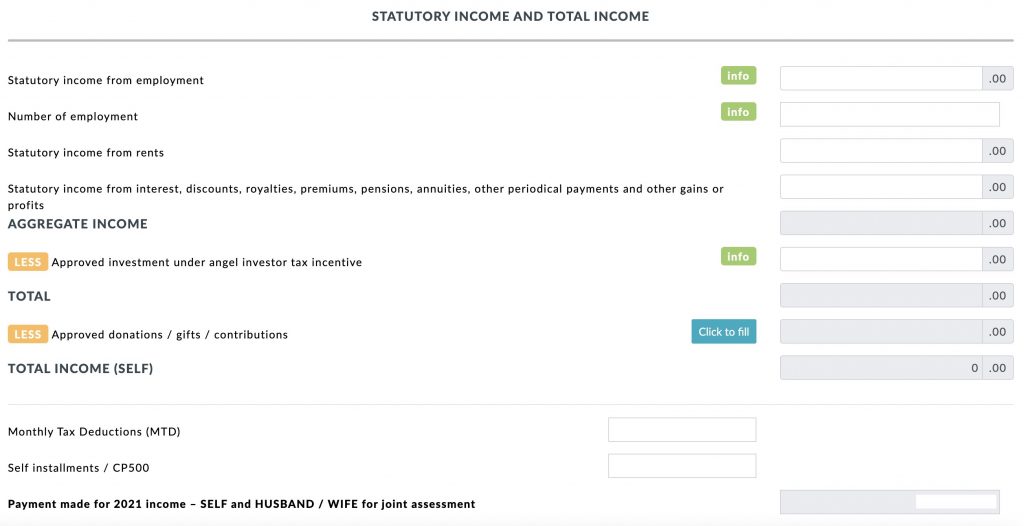

Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are. As for those filling in the B form resident individuals who carry on business the. Say your chargeable income for Year Assessment 2021 is RM65000.

In the case of a partnership you must provide a copy of your partners IC as well. 20 lakhs it must register under the GST. Sole Proprietorship Taxation.

A photocopy of IC front and back of you and partners if applicable RM 60 If your sole prop is using a. As such the owner receives all profits and makes all executive decisions for the business. This is because of the following laws set in place.

Within All Malaysia Government Websites. There are four steps to form the sole proprietorship in Malaysia. Additionally setting up a sole proprietorship still allows an opportunity for the business to grow.

The structure itself is simple to form. Unlike a corporation a sole proprietorship is not a separate entity from the person who owns it. Registration of companys tax file is the responsibility of the individual who managing and operating the company.

Suruhanjaya Syarikat Malaysia SSM Companies Commission of Malaysia CCM where you register your LLP get its birth certificate and do your annual declarations. Examples of side businesses are plenty including online stores on e-commerce platforms blogging. SOLE PROPRIETORSHIP Personal Name.

Income generated from freelancing reviews brand endorsements and social media promotion are subject to income tax as stated by The Inland Revenue Board of Malaysia Lembaga Hasil Dalam Negeri LHDN. Heres how to go about it. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives that are inaccessible to taxpayers with non-business income. The reasons for this are. As we explained as a sole proprietor youll report and pay income tax on your businesss profitâand youll do so by filing additional forms with your personal return Form 1040.

Registration under the Shop and Establishment Act of the relevant state. Should the owner ever decide to expand there is always the opportunity to change the business to either a partnership or a private. When you arrive at IRBs official website look for ezHASIL and click on it.

Lembaga Hasil Dalam Negeri LHDN Inland Revenue Board IRB who you pay your taxes to and where you register for tax filing. The first RM70000 of your chargeable income category F RM4400. Thus by switching to a Sdn Bhd 1 July 2020 31 December 2021 Janet would be able to enjoy tax benefit of.

Visit any Companies Commission of Malaysia SSM branch to complete the registration form. These taxes are referred to as self-employment taxes and. Total tax payable RM6500 before minus tax rebate if any Lets do another example.

The overall simplicity of execution. Since many freelancers earn money from these activities here are a few questions you may have on this topic. A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956.

This will lead you to the main page of the the e-filing system. MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia. For Sole Proprietorship a checklist is necessary.

Go to e-filing website. ROBA 1956 and Registration of Businesses Rules 1957 is a type of sole proprietorship and partnership business. Where a company commenced operations.

The lower cost for setting up the company.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

New Company Registration In Malaysia Enterslice Public Limited Company Private Limited Company Limited Liability Partnership

Income Tax Number Registration Steps L Co

Accounting Malaysia Importance Of Financial Statement By Beyondcorp

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Form 2290 E Filing For Tax Professionals Irs Forms Irs Employer Identification Number

How To File Income Tax In Malaysia 2022 Lhdn Youtube

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

Company Formation In Switzerland Corporate Bank Public Limited Company Switzerland

Essay Writing Service With The Best Essay Writer Team How To Write A Paper With A Thesis

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

5 Important Things To Know About Sole Proprietorship In Malaysia Trustmaven

Third Party Accounting Services In Singapore Makes You Completely Tension Free Accounting Services Accounting Bookkeeping Services

Sole Proprietorship Malaysia Comparing With Sdn Bhd